AI-Powered Roll-ups Part V: Build AI+Services Organically or Through Roll-ups?

A practical framework to determine the right path for building an AI-native Services company

As AI continues to reshape traditional service industries - from property management to logistics to insurance - entrepreneurs and investors face a critical question:

Should you build a new AI-powered services business from scratch, or buy and transform existing ones through roll-ups?

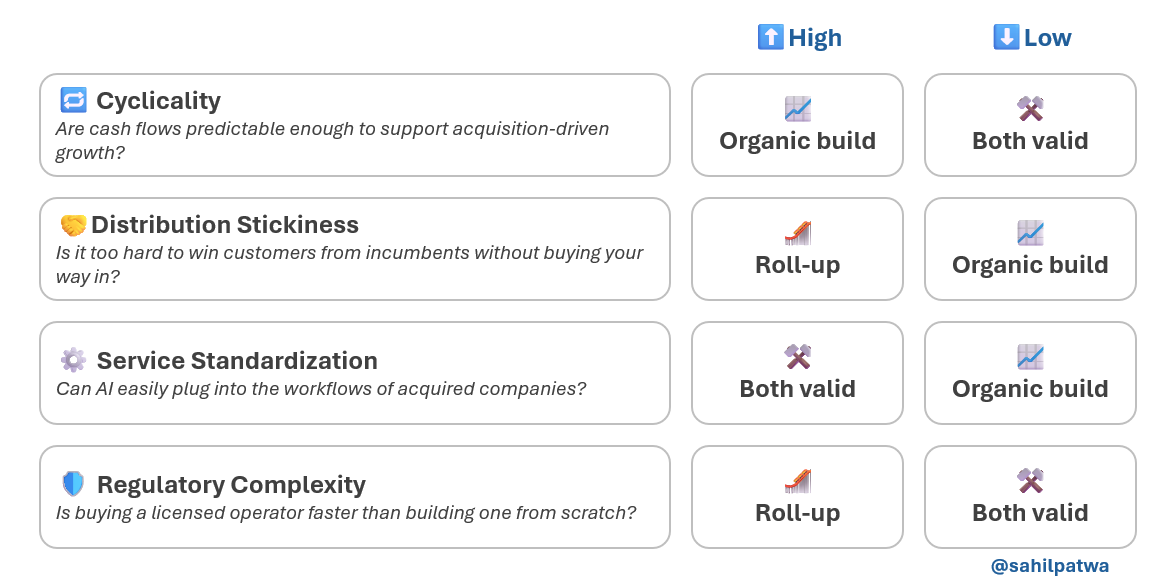

The right answer depends on the underlying characteristics of the market. Through experience and observation, four key criteria have emerged that can guide the decision:

1️⃣ Cyclicality

2️⃣ Distribution stickiness

3️⃣ Service standardization

4️⃣ Regulatory complexity

Let’s walk through each and explore when it points to organic builds vs roll-ups - with examples.

1. Cyclicality: Predictable Cash Flows Are Roll-Up Fuel

Why it matters:

Roll-ups rely on stable cash flows to service debt, fund acquisitions, and invest in platform R&D. Highly cyclical markets make this risky. In volatile industries, organic builds are safer and more adaptable.

Example: Recruitment Agencies (Organic Build)

Recruiting was on fire in 2021 - firms were turning away business due to a hiring boom. But by late 2022, the pendulum had swung: mass layoffs, hiring freezes, and dried-up demand. This kind of volatility makes it hard to build a leveraged roll-up. However, an AI-native recruitment platform - with variable infrastructure costs (like GPU inference tokens instead of headcount) - can flex up or down as demand shifts, giving it a structural advantage in cyclical markets.

See: Mercor

2. Stickiness of Distribution: Buy It if You Can’t Break In

Why it matters:

If customers rarely switch providers or think about alternatives, distribution becomes a moat. In sticky markets, roll-ups help you skip the brutal GTM grind - and the good news is, once you're in, you're likely to stay in. The same inertia that made it hard to win customers now makes them hard to lose. But if switching is easy, a better, cheaper AI-native service can grow organically.

Think of this almost as a novel GTM approach - you're growing through acquisitions because the LTV/CAC makes more sense that way than through traditional organic methods.

Example: Property Management (Roll-Up)

Most landlords don’t proactively look to switch property managers unless there’s a serious issue. Contracts are annual, but landlords typically stay with a manager for 4–5 years. Even when they're open to switching, the window is narrow - just weeks before renewal. This makes cold-start distribution brutally hard. Rolling up existing players and improving their efficiency with AI is often the only viable path at the beginning.

See: Dwelly

3. Standardization of Service Delivery: AI Loves Consistency

Why it matters:

AI thrives in environments with structured, repeatable workflows. Roll-ups only work when acquired companies can be brought onto a common operating model. In highly bespoke industries, standardization is difficult - better to start fresh.

Example: Investment Banking (Organic Build)

M&A advisory services are deeply personalized. Each deal is unique, strategies are tailored, and execution relies on hard-won client relationships. No two boutique banks operate alike - making post-acquisition integration a mess. Rather than roll up a fragmented landscape, a better approach is to build a focused, AI-native IB platform around repeatable tasks - like automating deal sourcing or first-draft materials - and expand from there.

See: Offdeal

4. Regulatory Complexity: Roll-Ups Can Fast-Track Compliance

Why it matters:

In regulated markets, going from zero to compliant is slow and expensive. Acquiring already-compliant firms can provide licenses, regulatory infrastructure, and domain expertise - saving years of effort.

Example: Financial Advisory (Roll-Up)

Providing financial advice isn’t just about trust and performance - it’s also about regulation. Advisors must hold certifications (like Series 7, 63, or CFP), follow fiduciary standards, and maintain compliance infrastructure for audits and disclosures. Starting an AI-native advisory firm from scratch means building all of that up, often over several years. Rolling up boutique advisory firms gives you immediate market access and regulatory coverage. From there, AI can be layered in to offer smarter portfolio analytics, faster onboarding, and scalable client communication - modernizing the experience without reinventing the compliance wheel.

See: AMCA

While not an AI Roll-up, AMCA illustrates this point very well in the context of defense/ aerospace (thanks for flagging this Evan!). Every legacy supplier they acquire already holds hard-won aerospace certifications (AS9100, FAA PMA, ITAR, etc.). Buying these businesses lets AMCA inherit decades of audit history and approved-vendor status, skipping the costly 'test- and-certify' cycle that a greenfield parts maker would face.

A Framework, Not a Final Answer

This isn’t a hard-and-fast playbook - think of it as a starting framework. Many companies will evolve past the initial conditions that defined their early strategy:

A roll-up that succeeds in building a reputation for quality and navigates regulatory hurdles might find it easier to grow organically, expanding its offering and reach without further acquisitions

Conversely, an AI+services business that starts with an organic wedge may find itself layering on selective, strategic acquisitions to accelerate scale, unlock new geographies, or enter regulated verticals

Or, they might follow completely novel methods to scale further

In other words: how you start matters, but it doesn’t lock in how you scale.

Build or buy - but start with clarity on the terrain.